online gold and silver

Add a review FollowOverview

-

Founded Date July 10, 2016

-

Sectors Software Development

-

Posted Jobs 0

-

Viewed 14

Company Description

The Strategic Funding: A Comprehensive Guide To Buying Gold

On the earth of investment, gold has lengthy been considered a protected haven asset. Its allure transcends time, geography, and economic circumstances, making it a novel addition to any funding portfolio. In this article, we’ll explore the assorted points of buying gold, including its historical significance, the different types of gold available for buy, how to evaluate its worth, and one of the best practices for investing in this valuable metal.

Historical Significance of Gold

Gold has been cherished by civilizations for 1000’s of years. Its rarity, sturdiness, and malleability have made it a most popular medium of trade and a symbol of wealth. From historic Egyptian pharaohs to modern monetary systems, gold has performed an important role in financial stability. Throughout times of financial uncertainty, akin to wars or financial crises, gold usually retains its worth or even appreciates, making it a gorgeous asset for investors looking for security.

Completely different Types of Gold

When contemplating an funding in gold, it is essential to grasp the assorted kinds in which gold may be bought:

- Gold Bullion: This is gold in its purest kind, usually produced in bars or coins. Bullion is measured in troy ounces, and its worth is primarily decided by the present market worth of gold.

- Gold Coins: These are minted coins made from gold, usually with a face worth. In style examples embody the American Gold Eagle and the Canadian Gold Maple Leaf. Collectors may search uncommon coins, which might command higher prices resulting from their numismatic worth.

- Gold Jewelry: While gold jewelry might be a gorgeous investment, it is important to contemplate that the worth of jewellery often consists of craftsmanship and design, which can not correlate straight with the gold content material.

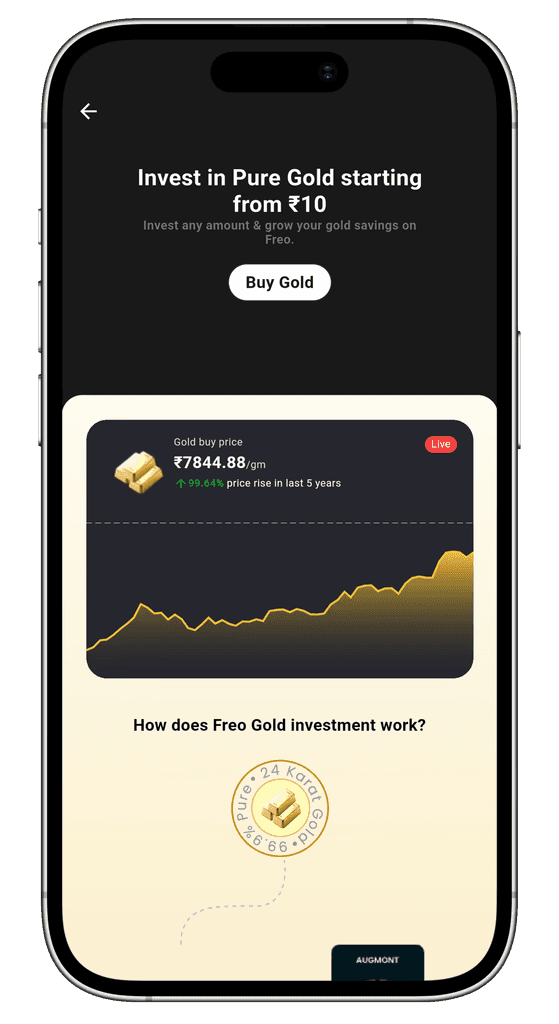

- Gold ETFs and Mutual Funds: For traders who favor not to hold physical gold, change-traded funds (ETFs) and mutual funds provide a way to invest in gold with out the necessity for storage or security. If you loved this informative article and you would want to receive more details relating to Buynetgold generously visit our page. These funds typically invest in gold bullion or gold mining corporations.

- Gold Mining Stocks: Investing in companies that mine gold could be another means to achieve publicity to gold prices. Nevertheless, this strategy carries extra risks related to the mining industry itself, corresponding to operational points and regulatory challenges.

Assessing the worth of Gold

The value of gold is determined by several elements, including market demand, geopolitical stability, inflation rates, and currency fluctuations. The value of gold is quoted in troy ounces and will be tracked via varied financial information shops and commodity exchanges.

When assessing the worth of gold, it is essential to consider the next:

- Purity: Gold purity is measured in karats, with 24 karats being pure gold. The higher the purity, the extra valuable the gold.

- Market Trends: Understanding present market developments and historic worth movements can present insights into when to buy gold.

- Economic Indicators: Components resembling inflation rates, curiosity charges, and forex energy can significantly impact gold costs. Traders should keep informed about world financial conditions that could have an effect on their funding.

Finest Practices for Buying Gold

- Research Reputable Dealers: When purchasing bodily gold, it’s vital to purchase from reputable sellers. Search for dealers with a strong monitor document and optimistic buyer opinions.

- Confirm Authenticity: Make sure that the gold you buy comes with a certificate of authenticity, especially when shopping for bullion or coins. This certificate confirms the gold’s purity and weight.

- Consider Storage Choices: When you buy physical gold, you have to a secure storage answer. Options embody a protected deposit box at a bank or a house secure designed for valuables.

- Diversify Your Portfolio: Whereas gold is usually a worthwhile addition to your funding portfolio, it should not be the only focus. Diversifying your investments throughout varied asset courses may also help mitigate dangers.

- Stay Knowledgeable: The gold market can be risky, so staying informed about global financial trends, geopolitical occasions, and changes in demand can assist you make informed choices about when to buy or sell.

The Psychological Side of Gold Funding

Investing in gold just isn’t just a monetary determination; it also entails psychological elements. Many investors are drawn to gold for its historic significance and the sense of safety it provides. During instances of economic turmoil, gold often serves as a psychological anchor, reassuring investors that they’ve a tangible asset that may retain value.

Nevertheless, it is crucial to approach gold investment with a transparent strategy and keep away from emotional decision-making. Understanding the reasons behind your investment in gold—whether for wealth preservation, hypothesis, or diversification—can help guide your actions available in the market.

Conclusion

Buying gold is usually a strategic transfer for buyers trying to diversify their portfolios and hedge in opposition to financial uncertainty. By understanding the different types of gold, assessing its worth, and following greatest practices for purchasing, investors can navigate the gold market with confidence. As with every funding, thorough research and informed decision-making are key to attaining success. Whether you choose to spend money on physical gold, ETFs, or mining stocks, the timeless enchantment of gold as a retailer of value continues to make it a compelling choice for each novice and seasoned investors alike.